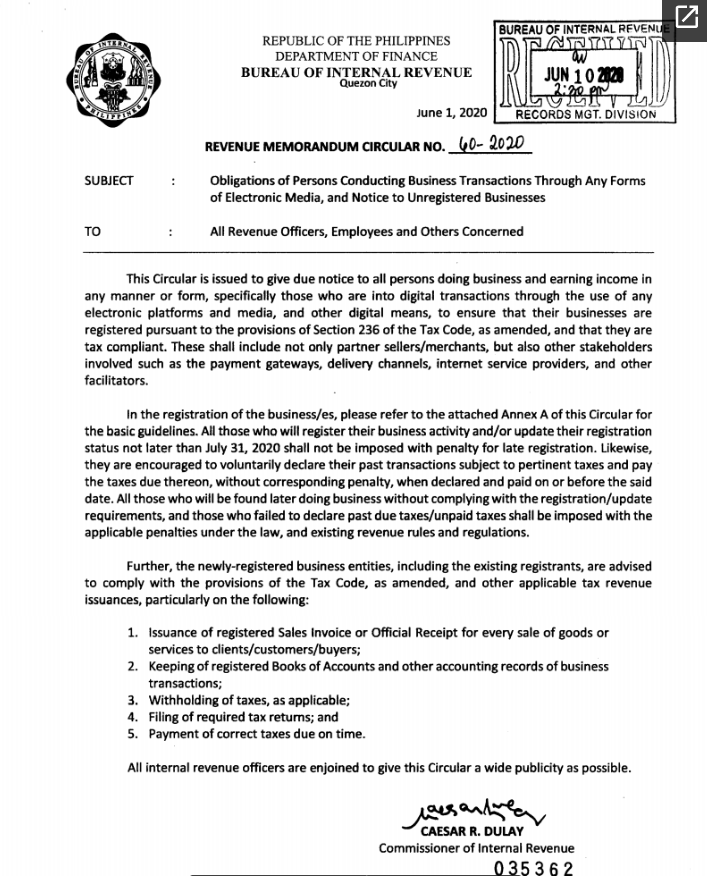

Bureau of Internal Revenue (BIR) urges online sellers who make money on digital platform to register business and pay taxes.

The BIR said they have to make sure to register their business in pursuant to the “Tax Code” as amended so that they can continue their business. The online tax comes to an effect after e-commerce exploded during the COVID-19 pandemic.

According to the BIR, the memo covers “not only sellers/merchants, but also other stakeholders involved such as payment gateways, delivery channels, internet service providers, and other facilitators.”

The BIR noted that online sellers are given a chance to register their business and get updated of their registration status until July 31, 2020 or else penalty is imposed for a late registration.

The BIR also offers digital businessmen to voluntarily declare their previous history of transactions that is subject to pertinent taxes and settle its due without corresponding penalty.

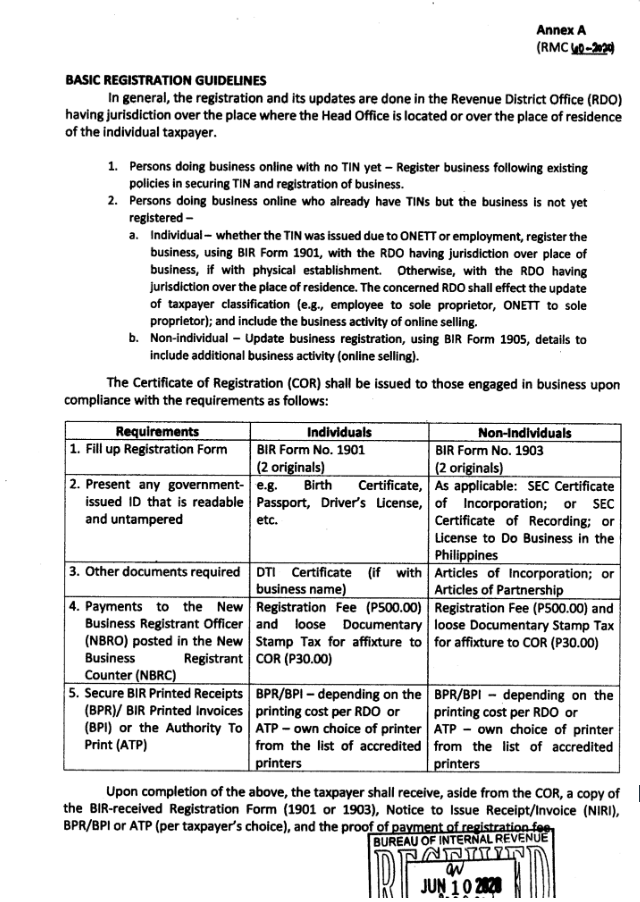

Read the PDF file below for guidelines on the registration.

However, Senator Joel Villanueva expressed sentiment over the plan of taxing online sellers noting that they’re small earners and it was their initiative to earn during the COVID-19 pandemic as they have not received government support.

Villanueva also noted that the BIR should focus their attention on POGO which have collectible tax of P50B since last year.

What can you say about this BIR taxing online seller? Say something here on the comment section below and join the discussion.