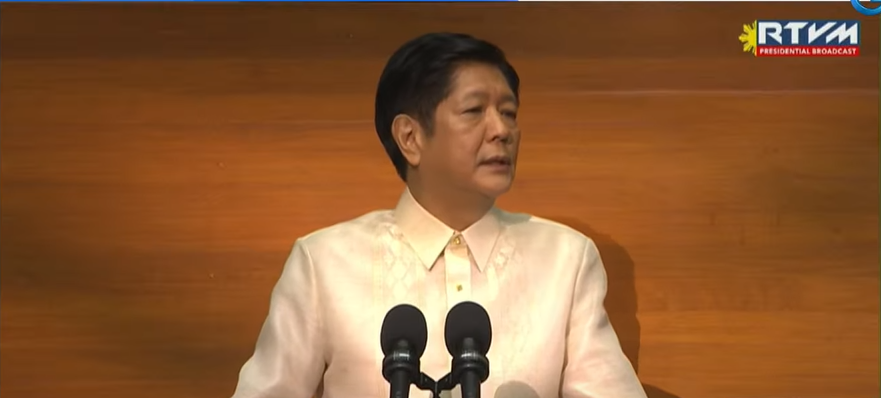

A tax on digital transactions proposed by President Ferdinand “Bongbong” Marcos Jr. may bring in P11.7 billion the following year.

In his first State of the Nation Address (SONA), Marcos promised that “Our tax system will be adjusted in order to catch up with the rapid developments of the digital economy, including the imposition of value-added tax on digital service providers.”

The initial impact on revenue, he continued, “will be around P11.7 billion in 2023 alone.”

The imposition of “correct” taxes on fees for streaming services and other online payments has already been openly advocated by the President’s chief economic adviser, Finance Secretary Benjamin Diokno, as a way for the government to raise more money. According to Diokno, the idea to tax digital services is being put forth “on the basis of fairness,” as opposed to traditional purchases, since digital transactions tend to “evade” paying taxes.

Meanwhile, Marcos stated that in order to encourage tax payment simplicity, tax compliance practices will be streamlined.

He declared, “We will pursue measures to determine possible undervaluation or trade mis-invoicing of imported goods.”

He continued, “Through information and communications technology, the Bureau of Customs will promote streamline processes.